By this time in my career, I am in my mid 40's, have attained the exalted level of executive, and have only worked for a few companies, but in a lot of different jobs. My company, Nortel, has gone through one near-death experience and is just about to start another one. I am running a fascinating business but cannot seem to get it positioned correctly in Nortel.

Meanwhile, our CEO was fired over an accusation of bad accounting, the board had hired a "Spanish Inquisition" legal firm to check this out and grill execs and employees, and our reputation was doing downhill. Executives seemed to come and go at a rapid pace.

In the middle of this, we get a new CEO, Mike Zafirovski, and again there is disagreement over market size. Is WIMAX a huge multi-billion market for infrastructure or a good few hundred million a year opportunity? I think the latter and this does not seem to be well received, so I start looking for new opportunities outside Nortel. At this point in my life and my career I am driven more by interesting work, good colleagues, and a good company than by ambition to climb the corporate ladder. I think this is fairly common among people as they age, you go from blind ambition to rational measured ambition to satisfaction with your station in corporate life.

4A Getting Beaten by Startups

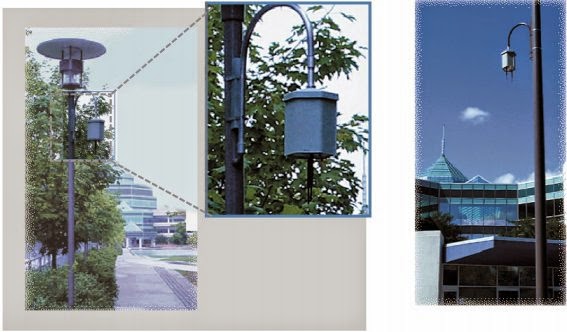

The mesh networking area in the early 2000's was hot, with a bunch of startups, but our product was pretty good. Everyone who visited Nortel and got a demonstration (see the photo) loved the product, but our sales were miniscule. Our R&D, Product Management/Marketing, and Operations team were excellent and I was very proud of the work they did. We had one big success with a big network in Taipei but then sales stopped. Meanwhile, our execs thought this would revolutionize the industry but I thought it was a more modest market opportunity. The startups quickly passed us in sales and I realized that each of them had a small dedicated sales force and my business had to use the Nortel carrier sales force. Our sales force was paid according to revenue generated and it was a lot easier to generate revenue with our big old products than new inexpensive products like mesh. Therefore, the sales force loved to use our product as a "dancing bear" demonstration for their customers to demonstrate innovation but then sell them upgrades to digital switches. Eventually, our product was surpassed and we could see that there was a bigger opportunity in the WIMAX area.Meanwhile, our CEO was fired over an accusation of bad accounting, the board had hired a "Spanish Inquisition" legal firm to check this out and grill execs and employees, and our reputation was doing downhill. Executives seemed to come and go at a rapid pace.

4B Transition to WIMAX

As the General Manager, I tried to pivot the Mesh R&D team to WIMAX and ran into all sorts of problems. Companies are difficult places to work when sales are dropping and layoffs are happening. Disputes over who designs hardware, who supports mesh, how much money could be spent, who reports to who, etc etc.In the middle of this, we get a new CEO, Mike Zafirovski, and again there is disagreement over market size. Is WIMAX a huge multi-billion market for infrastructure or a good few hundred million a year opportunity? I think the latter and this does not seem to be well received, so I start looking for new opportunities outside Nortel. At this point in my life and my career I am driven more by interesting work, good colleagues, and a good company than by ambition to climb the corporate ladder. I think this is fairly common among people as they age, you go from blind ambition to rational measured ambition to satisfaction with your station in corporate life.